- WHATS NEW IN QUICKEN 2017 FOR MAC

- WHATS NEW IN QUICKEN 2017 MANUAL

- WHATS NEW IN QUICKEN 2017 SOFTWARE

- WHATS NEW IN QUICKEN 2017 DOWNLOAD

- WHATS NEW IN QUICKEN 2017 WINDOWS

Reasonable efforts are made to maintain accurate information. *See the card issuer's online application for details about terms and conditions. CreditDonkey does not include all companies or all offers that may be available in the marketplace. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). †Advertiser Disclosure: Many of the offers that appear on this site are from companies from which CreditDonkey receives compensation. We publish data-driven analysis to help you save money & make savvy decisions.Įditorial Note: Any opinions, analyses, reviews or recommendations expressed on this page are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

The company shows no signs of getting rid of the product any time soon.ĬreditDonkey is a personal finance comparison website. If you're unhappy with your current software, it may be time to check out other options.īut if your Quicken subscription has be working well for you, don't worry. There are many tools available for tracking investments and managing expenses. And they're still pushing out new features and updates.

WHATS NEW IN QUICKEN 2017 SOFTWARE

Quicken has been in business for a long time compared to other personal finance software companies. Although they provided a new tool to replace it, some users feel it's an inferior product. The company also abruptly discontinued their Quicken Bill Pay feature in 2020. You'll get the latest features and tools each time you renew your subscription. With their subscription product, this won't be an issue-as long as you're willing to pay. Quicken has discontinued several versions of its software.

WHATS NEW IN QUICKEN 2017 FOR MAC

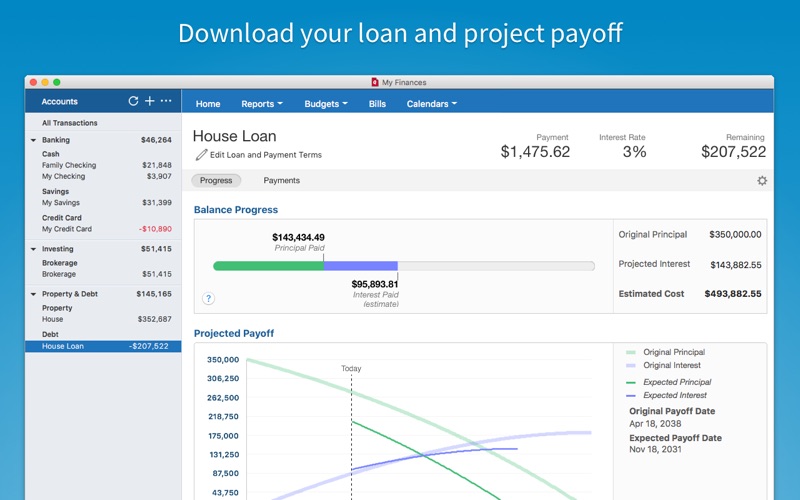

Quicken for Mac looks modern, but lacks robust planning and reporting tools.

WHATS NEW IN QUICKEN 2017 WINDOWS

Quicken for Windows looks more outdated but has more functionality. The two versions are also quite different. There's no easy way to transfer your data from one version to the other. Quicken has Mac and Windows versions, but they aren't compatible with each other. Instead of upgrading once every 3 years, users now have to renew every year to use the program. Since 2018, Quicken has switched to a yearly subscription model. If you had a copy of Quicken 2015, for example, you would no longer get updates or support after 2018. This eventually changed as Quicken started to discontinue their products after three years.

WHATS NEW IN QUICKEN 2017 DOWNLOAD

Just pop in the floppy disk (remember those?) or CD and download the software to your computer. In its early days, one Quicken purchase would give you access to the program forever. But some users feel these could be signs of Quicken going downhill. Naturally, it's been through a few transformations.

Quicken has been in the business for nearly 40 years. But fast forward 5 years and Quicken is still kicking. Some people thought the acquisition spelled the end of the software. As Quicken revenue declined, Intuit sold the company in 2016 to H.I.G. The program did everything, from tracking investments to balancing a checkbook.īut other alternatives emerged, and Quicken wasn't able to innovate fast enough to keep up with the times. It quickly became the king of personal finance software. When Quicken came out in the 1980s, it made a big splash. It’s like the perfect accountant, and you don’t even have to make small talk.But there are a few other reasons why some people think Quicken is on its way out. Still, for the household with multiple accounts to manage, Quicken is able to not only keep all of that information organized, it can generate reports to show you how your money is being used each month. You can still use Quicken’s advanced features to reconcile your digital check register with your bank’s data.

WHATS NEW IN QUICKEN 2017 MANUAL

Some users actually prefer manual entry, as it forces them to more closely examine each transaction.

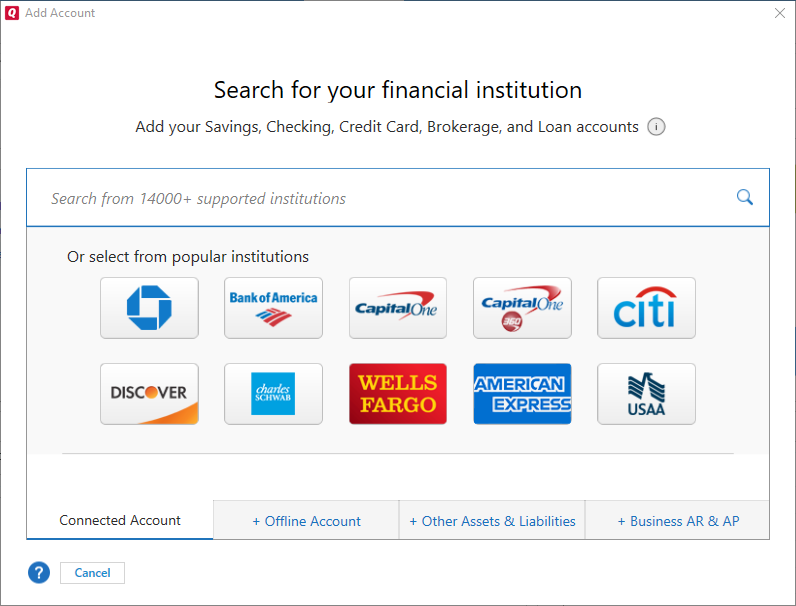

It keeps track of your money for you, so you don’t have to. In the mid-1990s, when banks went online for consumers, they introduced the ability to automatically download your transaction. They had to balance their checkbook against their bank statements each month. Those who even bothered to keep track had to use a paper register. Every purchase wasn’t automatically listed for you somewhere like it is today. When this software first hit computer store shelves, managing your personal finances was much different. Managing your accounts, from bills paid to quick debit-card transactions, is the foundational function of the Quicken software.

0 kommentar(er)

0 kommentar(er)